Modelo 300 - VAT form

Modelo 300 is the form for the quarterly submission of VAT. VAT is always submitted at the year quarters - January, April, July, October. A Modelo 390 annual return is also submitted in January. This gives details of what to expect.

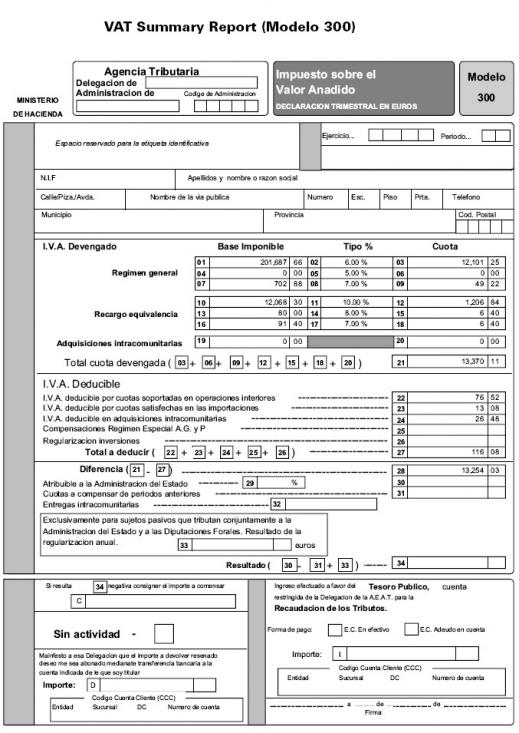

You can see a slightly out of date copy of the Modelo 300 form below for reference (the current version is Modelo 303)

The following is a draft translation/users guide in English. This cannot be taken as legal advice or a guide to filling in the form. If you are in any doubt, check with your Gestor or Lawyer. The Agencia Tributaria website is not friendly - everything is in legalese Spanish and answers to basic questions aren't easy to find.

Useful links: http://asesores.com/fiscal/ - it's in Spain, but it's relatively easy and it includes examples on the calculations and details of what is needed.

Around the web, I have seen information that suggests that submission will need to be done online from October 2008 and you will need a digital certificate to complete and sign the forms. http://spanishtaxes.blogspot.com/2008_01_01_archive.html

Devamgado is your invoices. Deducible are the expenses. If you export to the UK (eg do services for UK companies, there is no IVA due. Just put the figure in Entregas intracommunitarias. You will naturally have to pay income tax IPRV on this income)

Section 1 - Identificacion

Espacio reservado para la Etiquetta Identificativa - A barcode sticker. You will need to get a sheet of stickers with barcodes on from the tax office that goes here. So get the stickers you will need your NIE number once you have registered.

Address and contact details are straightforward. Note that provencia is not 'comunidad autonima" so Barcelona is a municipio in the provencia of Barcelona http://es.wikipedia.org/wiki/Provincias_de_Espa%C3%B1a

Section 2 - Devengo (top right)

Ejercicio is the year (eg 2008). Periodo is the quarter, written as 1T, 2T, 3T, 4T etc (T=trimestre)

Section 3 - Liquidaction - Financial details

IVA Devengado - VAT earned (your invoices in Spain)

Regimen general is the section for recording the main IVA that you have charged. There are three lines, one for each tax band (16%,7% and 4%). If you are selling professional services, the chances are you will only fill in one line, that for the 16% rate.

(Recargo equivalencia is aimed at individuals who are retailing as themselves and is a simplification scheme for small retailers so they don't need to issue invoices so you probably ignore this)

The three elements of each line are

- Base imponible - ex-VAT sales total

- Tipo % - the VAT rate appicable, probably 16%

- Cuota - the amount due (tipo % x total)

Adquisiciones intracomunitarias If you have made purchases from the EU, as a business you shouldn't have paid VAT on these goods/services purchased. But you have to declare the purchases and effectively charge yourself IVA. You then deduct the cost of the purchases as a charge in IVA deducible en adquisitiones intracommunitarias (assuming it is VAT deductable) and effectively pay no IVA (the UK works the same way). The cuota here is the amount of VAT a Spanish company would have charged you for the same goods.

IVA Deducible - VAT to be deducted

These are the VAT deductable items. As with the UK and most countries there are items that can and cannot be included. I'm slightly unclear as to why line 23 exists, so I may be mistranslating. Deductions in general will just go in box 22.

- IVA deducible por cuotas soportadas en operaciones interiores - VAT to be deducted for operations in Spain (interior?)

- IVA deducible pors cuotas satisfechas en las importanciones - VAT to be deducted on imports (not sure on this)

- IVA deducible en adquisitions intracommunitaries - VAT on acquisitions acquired from the EU. Commonly this will balance against the amount in box 20 - in other words you charge yourself IVA then claim it back on the same form.

The last two lines are for special regimes and investment rebalancing. I don't understand what the last one is for, but presume it isn't relevant for most people.

Diferencia and resultado

The last part of this section are some final adjustments and then working out what you should pay.

- Atribuible a la Administracion del Estado is only relevant for businesses in Pais Vasco and Navarra and is an extra tax charge for these regions (boxes 29,30 and 33)

- Cuota a compensar de periodos anteriores are adjustments for previous submissions. These will need to be balanced in the end of year Modelo 390.

- Entregas intracomunitarias is the total value of exports (deliveries) to the EU - it's not used in the calculations, but you have to declare it. So if you have only made sales to the UK put those here, not in the IVA Devengado.

The result (total to pay or claim back) goes in box 34.

Section 4 - Compensacion

If you are due a VAT repayment take the amount to be repaid from box 34 and repeat it here.

Section 5 - Sin actividad

If you have not traded (no sales and no costs) mark here with an X and just complete the identification, quarter and sign.

Section 6 - Devolucion - Repayment

According to the notes, you can take an actual repayment at the end of the year (4T). It doesn't read that you can get an actual repayment at any other time. You should say the amount you want to be paid to you and the bank account.

Section 7 - Payment

If you are due to pay, then you will need to pay - you may be fined for submitting your return late or not paying the amount due.

Forma de pago - form of payment

- EC En efectivo - Cash

- EC Adeudo en cuenta - the bank account below (I guess generally most people would tick here)

Section 8 - Sign and date (don't forget to do this)

Business and self-employment

Business and self-employment